The Wolf Of Gamestop

How Reddit flipped the market upside down

March 11, 2021

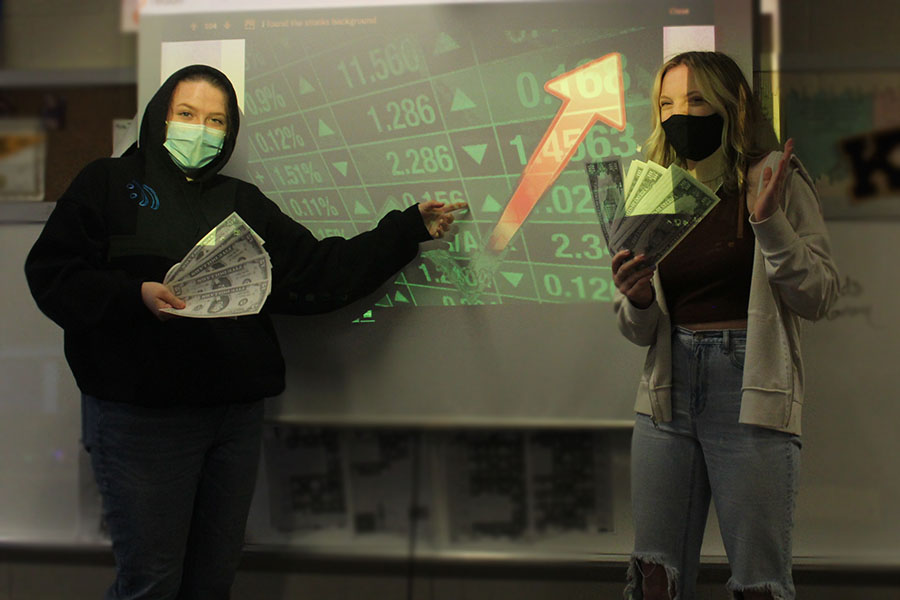

At the start of the year, a to buy a share of Gamestop would cost you a little under $20. On January 27th, 2021, when markets closed, Gamestop shares had skyrocketed to $350 dollars a share. Thousands of everyday people got in on this investment and made thousands of dollars. Billionaires invested in hedge funds lost millions in investments. The stock market has been flipped upside down.. The real question is, who is to blame, or thank, for this? Well, for that honor, you can thank one of Reddits college students who wanted to pay off his college loans.

Stocks, in a short explanation, are stakes that investors use to invest in a company that they believe will become successful. So, the higher the price that one share(stock) is, many people have invested. If it’s lower, not as many people have invested.

This really shows the huge dynamic that Gamestop went through in the past year.

Gamestop is a video game reselling company that, for the most part, sells all of their games by disc. Well, with this generation’s recent digitalization of anything from movies, music, and photos, it wasn’t long before a video game company like Gamestop became obsolete like so many others that couldn’t keep pace and slowly fell out of irrelevance. But even with Gamestop having one foot in the bankruptcy line, the Stock Gods of Reddit managed to create a miracle and bring the established Game company back from the dead.

This wasn’t the only company that made a 180 degree comeback. One of the mainstream movie theater companies, AMC, managed to flip the stock market upside down with it’s recent influx in stake price. Even a company like Blockbuster, that’s been bankrupt for 11 years, almost gained some stock.

So, with all this craziness in the market and all the up and down stalk talk, it’s pretty obvious that there are going to be some winners and some losers. So, who are they? Well, basically, the big name rich wall street buffs lost big, and the everyday citizens of America hit big.

Before going any further, I should break down how this all even started in the first place. It all started with a small time financial analyst by the name of Keith Gill. Gill is a big part of a giant group of people on Reddit called r/wallstreetbets. Gill started this back in 2019, when he bought $53,000 worth of Gamestop stock, believing that it would rise. In January of 2021, he shared this information with the 1.5 million people of the reddit group. Eventually, the word kept spreading and reached millions of people. Gill saw his investment jump from $53,000 to $48,000,000 in a very short period of time.

While everyday small investment stock brokers on Reddit made millions off of a dead company, Wall Street hotshots became furious. This is because a lot of these investors invest in something called hedge funds. Hedge funds, in simple, is a process that usually protects investors from uncertainty in the stock market, and maximizes profit while minimizing risk. But because the gamestop blow up was so unpredictable, there was no way for investors to cover the collateral. This caused hundreds of investors to lose millions. Some of the big investing apps, like Robinhood, even closed down their markets. Brokers even got so mad, that they are calling for lawsuits against the creators and contributors of the r/wallstreetbets thread.

Now, before you go out and dump $30,000 in a dead company, you should be aware of a few things. If you’re going to try and put a bunch of money into a very, very expired company like Blackberry or Blockbuster, then you should be ready to try and convince millions of people to invest as well. Because none of this would be possible without Gill convincing half of the users on Reddit. You should also be ready to take a lot of heat and threats from Wall Street Brokers, because they’ll come at you with every lawsuit they possibly can. Even though investing seems pretty easy to do, it’s very risky, especially when investing a lot of money into a risky market.

That wraps it up for our Wall Street drama. Although most of the craziness in investing has died down(for now), it will stand as one of the craziest and most unexpected turns in the recent history of economics. It really shows how everyday people can make a huge change in everyday life if they really want to. So, to all the other stock stalkers out there trying to make a quick buck, watch for some of these dead companies. Because this decade has been unpredictable, and yea never knows what’s going to happen.